For Wealth Builders Earning $500K+ Per Year

Step 1: Watch The Video: No cost, Just Clarity

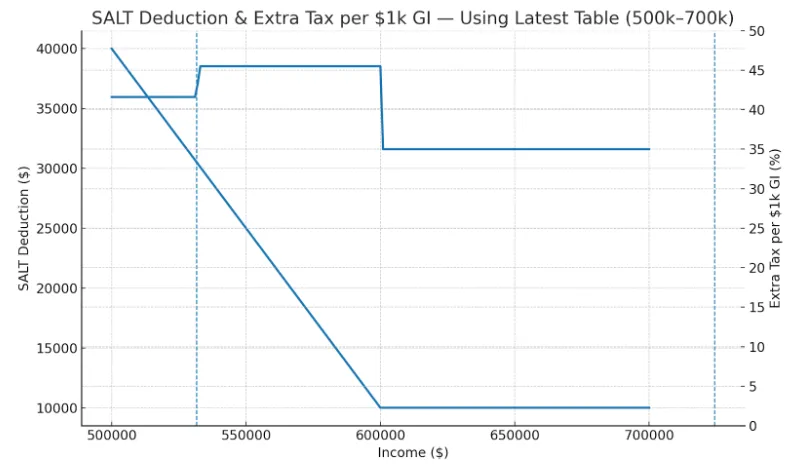

Will You Fall Into the New $500k-$600k Tax Trap?

A little-known provision in the new tax law - the One Big Beautiful Bill - could quietly cost some households up to $30,000 in lost deductions starting in 2025. In this 4-minute video, Ross Atefi, AAMS, CRPC, CCPS explains who’s affected and what strategies can still help you avoid the trap before year-end.

As Seen In

Step 2: Get Your Personalized Tax-Trap Strategy Call

If your income is above $500k+/year, now is the time to find out exactly how the new law could affect you.

In this 20-minute Tax-Trap Strategy Call, Ross Atefi and his team will:

Quantify how the One Big Beautiful Bill impacts your 2025 tax picture

Identify overlooked deductions and smart year-end moves

Outline next steps to help you avoid unnecessary taxes — before December 31

⚠️ Only a limited number of complimentary calls are opened each week.

How a $600k household can lose $30k in deductions under the new law

With Yatra Wealth Design, you'll get:

Proactive tax and wealth strategies tailored for $500k+ earners

Dedicated fiduciary guidance — no sales pitch, ever

Custom financial plan and portfolio aligned with your goals

Family Office Experience covering taxes, insurance, and estate planning

AAMS, CRPC, CCPS

Your information is 100% confidential. We never share or sell client data.

Disclaimer: Yatra Wealth Design is a Registered Investment Advisor. Tax discussions are for informational purposes only and not individualized tax advice. Please consult a CPA for specific recommendations.

The information on this Web site or in emails is designed for educational purposes only. It is not intended to be a substitute for tax, legal or accounting advice.

Copyright © 2025. All rights reserved.

The content on this website is protected by copyright law. Unauthorized use or reproduction of this content in any form is prohibited. You may not copy, distribute, or otherwise use this content without the express written permission of the copyright owner.